Most of the advises we read or watch from social media like Tiktok, FB, Youtube and Twitter with regards to investing will normally suggests of how we should avoid buying unnecessary things and investing our money to grow it and be prepared financially for the future. Advises include saving as much as you can and then later use it to grow your finances.

- What did I do last time to Save and Invest?

- My personal Budget which came from my Salary alone

- Select a good Company that helps with your Retirement Fund

- How is my Income Distributed?

- Investment fund

- What is an emergency Fund?

- What is a Sinking Fund?

- How Is My Finance Distributed after Becoming a Financial Advocate and Doing Investments

- My Income Distribution as of 2022

- My Side hustles Income Distribution

- Final Thoughts

Saving is the very first step we need to master if we want to invest in the future. After all everyone needs money to invest.

For employees like us having a guide on this matter will be of great help for securing our future someday and be financially independent later on. We know for a fact that investing will provide more passive income and we need this as we cannot fully depend on our personal job income, as we can only work up to 65 years old (for most of us) as we want to enjoy life as we grow older.

Let your money work for you, as Warren Buffet said.

What did I do last time to Save and Invest?

Here I will share to you my experience as well how I transition from saving only to saving and investing which I personally learned its importance . This is one of the reasons as well why I become a financial literacy advocate, I got inspired to share my experiences after learning the basics and experiencing its benefits first hand, It changed a lot in me. We’ll there’s no looking back after doing 2 websites and 2 youtube channels all related to financial advocacy and information disseminations now.

In my case, I only learned about investing in the stock market after my 3 years working in a multinational company here in Malaysia. I was working for about 10years in Philippines before I decided to move out and try my luck overseas as my salary in Philippines could not afford me to pay for a house amortization and so as not to worry whether I will have enough money for emergency matters.

Even before I learned about the stock market the only thing I know to accumulate wealth back then was to save money, I’m good at it, I can budget my money to the slightest details but It always seems limited and you can predict how much I can earn by just knowing my salary. So I tried to search the internet (lucky during this time as we start to have faster and cheaper internet then) and found out that those who are looking for financial freedom always start out in the Stock market.

Most wealthy people own stocks of companies which are successful, take a look at Tesla and SpaceX owner Elon Musk.

Local people also in our company even at young age (early graduates) already know the concept of investing and had been doing it for some time. People here started odd jobs already even at young age or before graduation in college. So I’m quite amazed at how knowledgeable people here, unlike in Philippines where few people take notice about it during my time. We might have better information about financial literacy now as we have more people advocating financial independence.

Looking back when I was in Amkor Philippines in Sucat Paranaque, there was once a seminar about investing in mutual funds, I never took interest back then as no one in my peers are doing it. Your circle of community really do influence you a lot as to how you think about financial topics. To develop yourself and your interest in investing, and financial matters, read books or online articles and follow people who are advocates or have been successful.

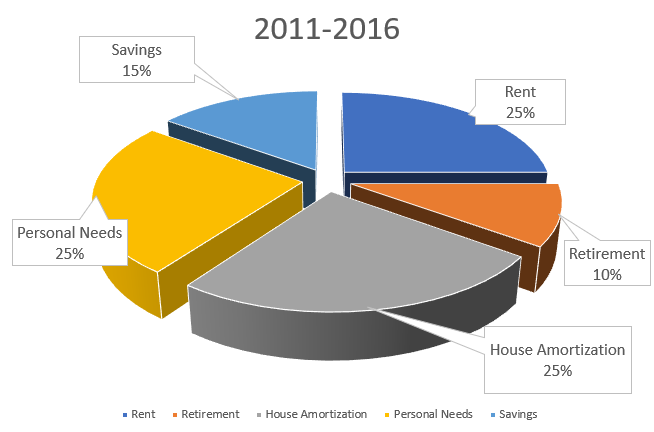

Here’s how I was distributing my salary as an OFW when I started working in Malaysia, take a notice at the difference after I started to learn more about investing in the stock market over the years. I started on budgeting at first and then migrated to saving + investing mindset.

My personal Budget which came from my Salary alone

Select a good Company that helps with your Retirement Fund

I was lucky on the company that I am working now as they have some sort of retirement fund which is about approximately10% of my salary (known as EPF, Employee Provident Fund here). I will be talking about this on my next blogs update so make sure to check it. Funds invested here have a compounding effect and pretty much similar to Pag-ibig Mp2 savings I made a blog report last time.

How is my Income Distributed?

So for the income distribution, major bulk of distribution is that 25% is going to my house amortization and only 15% is to my savings, I am still paying my house through pag-ibig plan, hope to finish in a couple more years (Yes, that would free up another capital for investment later on).

25% goes to my food, travel, internet, water, gasoline and personal entertainment. While the other 15-25% goes to my rent here. It varies a lot because at the start I live together with other Filipinos in the house so the more people the less I pay for the rent. This is quite common here, we share houses as well to share the expenses for renting a house. As of now I manage to rent my own house already.

That 15% is all savings I allocated for investing in the Stock Market. At first few years on work I was just saving money but in 2016 I began investing in the market as this was the first time I learned about stocks, dividends and trading, yes its very late. Lucky are those who have known about the market in their early years and started early investing.

And that’s it.

I missed a couple of things if you have been reading some financial blogs which includes emergency funds and sinking funds. I did not have debt when I move abroad, thanks to my frugality throughout the years I only spend what I make.

Sure I have couple of mishaps also financially, but I did not borrow money for long time, I always pay it up once my salary comes so I was not indebted to anyone not even to my family and siblings. This takes discipline as well which I think most OFWs are having a hard time even in modern times such as now. People tend to use more than what we can produce from our income, although we know this depends on everyone’s personal circumstances, side hustles and side income will help if our current salary is not enough.

Investment fund

When I started out investing in the stock market, I dedicated all my savings in my stock portfolio so I went 100% on stock investment as I was inspired on the earnings from those who have initially invested in the market.

This investment fund was intended to grow as I put in more money over the years. Currently my investment portfolio is in 7 digits now and still growing.

I plan to use this fund also to build other sources of passive income in the future.

What is an emergency Fund?

Emergency fund is money set aside for unforeseen events such as medical expenses, sudden car repairs or family mishaps.

This will save you a lot of stress in times that unexpected events happen. It occurs to everyone so make sure set-aside for it. Remember we had pandemic that happen where we cant work and earn properly, in this times you can appreciate what an emergency fund is.

You can also avoid getting in debt if you have this extra fund. Debts incur interests now adays so you will loss more money by the time you need extra funds as you need to payback the interests. Also as I mentioned to maintain healthy savings and funds for investments, do accumulate debts. They should only be use as a last resort when you really need that money. Don’t borrow money to buy things that will later not be usable to you.

Most advise to have at least 3-6 months of your current salary base for an emergency fund. It’s a good amount. In the case that you lose your primary job, it will help buffer time (in months) when you don’t have source of income.

But so as not to be stressful filling up this requirement, what I did was to save a certain percentage of my salary, no limits up to when I will stop accumulating.

What is a Sinking Fund?

This is the funds I save for activities that are pre determine. To be able to allocate the correct amount for the sinking fund.

1. Set an attainable goal to which you will need achieve in a period of time. For example when I travel back to Philippines to visit my family I can allocate a certain percentage from my salary. If my travel fee back and forth is 18,000 pesos (this is the average I see when I travel back), I can allocate 1,800 pesos each salary day and save it so at the end of 10 months I can use it to fund my bookings. 18,000 pesos is attainable in a year if you are working abroad. Saving money in small amount intervals will not hurt much your monthly budget.

2. Calculate the actual amount needed and the percentage amount you will get from your income every month. For our example above its a small amount and attainable in several tranches of savings as Malaysia is near to Philippines. If you are working in father place like Europe, the amount needed is higher. Travelling one way from London to Manila will have a cost of up to 80,000php and 160,000php for a round trip. If you go home every two years, your sinking fund would need at least 7,000 pesos per month. This is around 106 pounds per month worth of savings which I think is attainable with 3k pound salary. This is around 3.5% of the basic salary.

How Is My Finance Distributed after Becoming a Financial Advocate and Doing Investments

My Income Distribution as of 2022

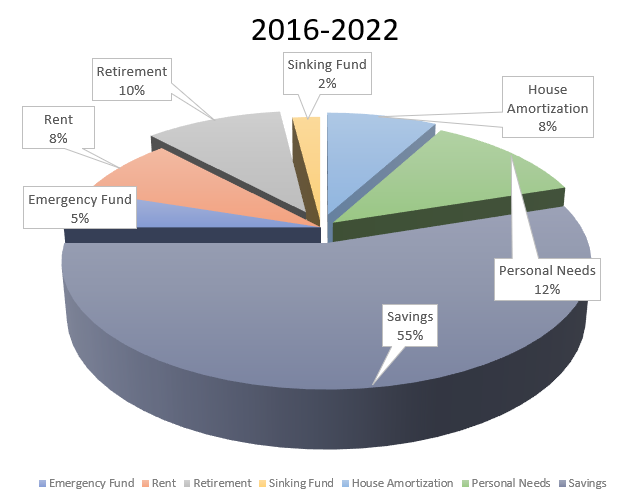

After learning ways on how to invest in the market and earning from my side hustles and side income, the distribution of my salary income is now as below.

There are significant changes on the percentage as there are several factors like increase in Salary so now percent distribution on my House Amortization is lower but in effect the actual value is slightly higher now because as I mentioned my salary is higher today as compared 10 years ago. One advantage also of being OFW is that you can earn more as time goes by. Salary increases so the expenses from other distribution goes lower so that savings income become higher.

My savings have significantly increase from my early beginnings of 15% to 55%. Though not all the time I can maintain this scenario, most of the time I try to and manage to save as much as I can for my investments in the Market.

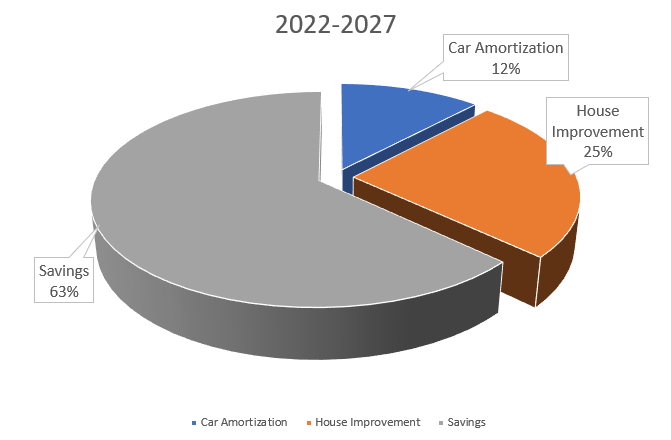

My Side hustles Income Distribution

Since I started my social media, youtube channels and websites and got some good investments results, I started accumulating some income as well so I created this income distribution plan for my future investment projects. Some of this is allocated for stock investing but I have not shown the breakdown here. This is where I get a portion to continue accumulating shares from good companies.

12% I am allocating for my car payment as I recently used part of the earnings to buy a car in Malaysia. You can see that a portion of my earnings is for my car amortization as I recently bought a replacement for my old car.

25% is for the improvement of the house that I am currently have monthly amortization (yes I’m doing house improvement at the same time) and the rest 63% goes to future investments allocation.

In the future I also plan to do a major investment in rental property (as of the moment this is just the plan) and I am just waiting for the right time when to start, but the funds are there to be executed only.

Final Thoughts

All financial achievements mentioned here started from the concept of saving money to later finance my goals either in the short term or long term.

We need to get prepared and saving from income only does not help much as it has its limitations, we need to invest as well to grow our earnings overtime and let our money grow. The side hustles and side income is needed as we can’t continuously do our current jobs in the long run. Remember we will have to retire some day.

We have limitations as well and the earlier we realize this the faster we can adjust for the future that we want to achieve.

As I frequently mentioned, you can check our Patreon Channel if you want to learn what I am doing for side income and side hustling as well. Check my Patreon channel for Stock market Investing and Patreon channel for establishing your online side income.